BitMEX.com Review

***Update: Bitmex has legal problems with the CFTC, their founders are on the run. We do not recommend trading with Bitmex, you dont know when they will be shut down and your funds may be at risk. ***

Great alternatives for Bitmex are:

- FTX.com for Crypto and Stock Trading with Leverage

- PrimeXBT.com for Trading without KYC

- Deribit for reliable Bitcoin and Ethereum Trading on Leverage

- Bitfinex for high volume Trading on Leverage

If you want to know more about Bitmex.com anyway – here is our review from the times before they got legal problems and introduced mandatory KYC.

Review Contents

- About the Company

- Getting Started with BitMEX.com

- Available Order Types

- Deposits & Withdrawals

- Trading Fees

- Supported Trading Pairs

- Website Features/Interface

- Customer Support

- Supported Countries

- Exchange Security

- User Experience

- Frequently Asked Questions – FAQ

- Pros and Cons

- Conclusion

Company Information

The website has been operating since 2014 and has their base operations setup in Hong Kong. Though we ’re unable to verify the physical address of the website, we have confirmed key personalities behind this successful crypto trading website. Leading the pack is Arthur Hayes, CEO of BitMEX which is an experienced derivatives trader and banker. Alongside his leadership are CTO Samuel Reed and Ben Delo, the company’s CSO. Samuel Reed is an expert in creating fast, real-time web applications that are perfect for the ever-changing trading website niche. Ben Delo, on the other hand, is an expert in creating high-frequency trading systems that acts as the binding agent for the three talents behind this amazing website.

Just recently, Arthur Hayes, CEO of BitMEX was invited in the show Fast Money by CNBC and explained why BTC would reach up to $50,000 in the near future. Please click the picture above to be redirected to the original video posted by CNBC on Twitter.

Getting Started with BitMEX

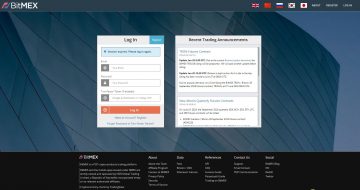

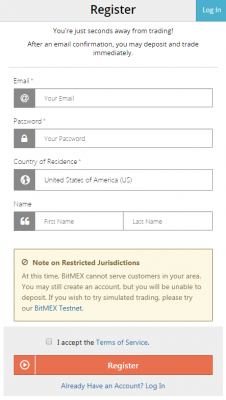

Now that we’ve talked a little about the website, let’s try and create an account with them! The first thing that we need to do is head on to their website www.bitmex.com and register an account. You can also use their app, if you prefer trading mobile. To create an account with them all you need to have is an active email address that you can use to confirm the registration and you’re good to go. After providing the active email address, please provide the country of residence so that the website may determine if you are eligible to create an account with them or not.

Not all countries are permitted to deposit but are still able to create an account with the website. If you are one of those people that are unable to create an account with BitMEX.com then we strongly advise you to create an account under their test website which is quite awesome, to be honest.

Shown above are the official and test net logo’s of BitMEX

Their test net website is able to provide users with the experience that they would originally get if they have an account with the official website. To create an account with the test net website, just visit testnet.bitmex.com

Another great thing about BitMEX.com is that they support anonymous trading. This means that the website does not require KYC in order for a trade to experience the full potential of their services at the moment. This can change any time though.

+++ 2020 August Update: Bitmex officially requires KYC from all users +++

The signup process on both official and test website are easy and hassle-free. It would not be a problem for people that just want to create an account so that they can snoop around the website and know more about them. If you haven’t created an account with them yet, why not create one now so that you can explore the website with us?

Trading with BitMEX.com and available Order Types

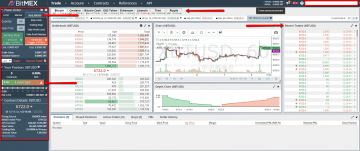

Now that we have BitMEX accounts, it’s time to look into their trading platform! Both of the websites (official and test website) have the exact same design and all the useful tabs and buttons are located at the exact positions. This makes it easier to shift from one website to another without having to sacrifice any important aspect of the real trading platform. The only difference is the color of the logo used on both websites. The official website has a red and blue logo while the test website has a green and blue logo to differentiate them from one another.

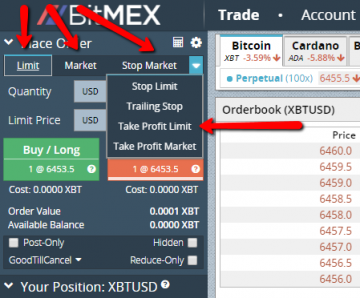

To place an order, all you need to do is head on to the left-hand side column where the “Place Order” tab is located. Here you will be able to place an order easily by clicking on the order method you want to go with. They have seven order types that you can choose from which we will be discussed below:

- Limit – Limit Order or just simply “Limit” is the most common order type that any crypto trader knows. This order type can be found in almost all online crypto trading websites today. And the function lets the trader buy or sell at a given price or a much better one for a larger profit.

- Market – Market Orders are orders that are best placed or used when you have a good internet connection. This is because market orders make use of micro trades which helps you execute the best price on the market in just a few seconds. If the trader has latency problems, then we would not recommend using this order type.

- Stop Market – A Stop Market order or Stop Order is an order that is made when it reaches a specific entered amount on the order tab. The trigger price is what creates the stop market order and becomes a market order once the stop price is obtained.

- Stop Limit – Just like the stop order mentioned above but this option allows the trader to set the price of your order once the price is achieved. If your trigger amount does not match any orders on the book then your position will remain open until it is filled.

- Trailing Stop – A Trailing Stop Order sets the stop price at a specific amount below the market price with an attached trailing amount. How does this work? Once the price of the chosen market rises, the stop price rises by the trail amount but if it goes the other way around (falls) then the stop loss price doesn’t change at the same time a market order is made when the stop price is achieved.

- Take Profit Limit/Market– Take Profit Limit works like a stop order but triggers are set in the opposite direction. Traders will be able to use this order option to setup an exit position or use it as an entry for a new position in the future.

Once an order option has been chosen, you just need to click on the quantity and the option that goes with the order that you are going to make. After entering the quantity details, the next thing you want to do is click to either buy or sell crypto from the market.

On the lower part of the order tab, we have the leverage option which can be used by professional traders to have margin trades. We emphasized “professional traders” because leverage trading is a very risky option that is not advisable for new traders.

If you are a professional trader and you completely understand the risks involved in trading with leverage then this part of the order tab will be of great help to you.

The maximum leverage provided by the website is 1:100. This means that for every $1 trade, the website will be able to provide a maximum leverage of $100 which also means that the trader needs to put up 1% of the trade; which is really huge in comparison to most of the crypto trading websites today.

Available Crypto to trade in BitMEX: BTC, ADA, BCH, EOS, ETH, LTC, XRP

Mentioned above are the available currencies that can be traded on the website. Now unlike other websites today that offer fiat deposit methods, this website only accepts BTC deposits which we will be talking about below. Trading with the website is both an eye opener for new traders and an experience at the same time. It literally isn’t that hard to just create an account and jump right into it. The trading aspect and the exploration of the website go hand in hand perfectly that it’s uncanny even to the experienced trader.

Getting your money in and out of the website

Now that we’ve talked about the website, how to create an account, and of course, how to trade; the question still remains, how do you get your funds in and out of the website? As mentioned earlier, the website only accepts crypto deposits and doesn’t have any options for Fiat.

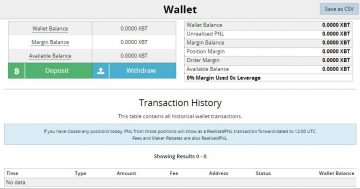

To deposit funds into your account, just simply click the Account tab located on the upper part of the website. The website doesn’t charge any fees for funds that you want to deposit but they do charge for withdrawals.

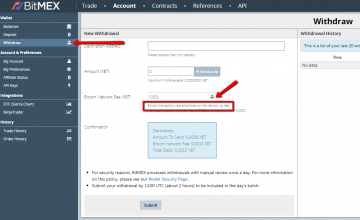

For withdrawals, users will be able to choose between a range of network fees that they want to pay for. If you want a faster fund transfers out of your account then you need to pay a higher network fee. The minimum fee is BTC 0.001 and the maximum is BTC 0.05. This dynamic feature is shown on the screenshot above.

Withdrawals are being processed manually once per day, this means that you need to submit your withdrawal request before 13:00 UTC to be included in that day’s withdrawal request batch. This method might be slow compared to automated withdrawal systems but BitMEX takes withdrawal security seriously and the processes require manual checking and validating.

Bitmex Fees

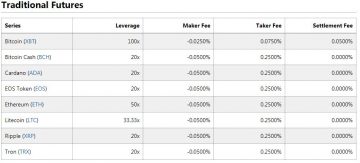

Let’s talk about FEES! There are a lot of fees involved when talking about an online crypto exchange website. BitMEX.com isn’t an exception and knowing how much you need to pay per transaction is as important as knowing how to get your money and in out. Below are the fees that can be found on their fees tab which can be accessed on the lower part of their website.

- Perpetual Contracts – For perpetual contracts the charge for BTC with a leverage of 1:100 would be -0.0250% for the Maker and 0.0750% for the Taker. Long funding is 0.0100% and short funding is -0.0100% with a funding interval of every eight hours.

- Traditional Futures – For traditional futures, please see the screenshot above.

- Upside Profit Contracts – For BTC with the leverage of 1x the maker fee is free, taker fee is free, and there’s also no charge for the settlement fee.

- Downside Profit Contracts – The same goes for downside profit contracts with the leverage of 1x. The maker fee is free; taker and settlement fee are free as well.

For those of you who are not familiar with the Maker and Taker fees then here’s a very short explanation: Maker fees are settled when you add liquidity by placing a limit order (on the order book) below the ticker price for a buy option and above the ticket price for sell. Taker fees on the other hand are settled when you take out liquidity from the order book by placing an order that is executed against an order on the book.

New users can save on the trading fees for half a year when they use a promo discount code like this one when they sign up. Bitmex discounts the trading fees by -10 for them.

Supported Trading Pairs

- XBT/USD

- ADA/XBT

- BCH/XBT

- EOS/XBT

- ETH/USD

- ETH/XBT

- LTC/XBT

- TRX/XBT

- XRP/XBT

Website Features/Interface

At this point, we generally have an idea how to create an account and go around their website and explore their trading platform. We would just like to point out that the design of their platform is impressive. It’s got a lot of important tabs but does not clutter! If you have gone through more than ten websites that offer the same services as BitMEX does, then you would know what we mean by this. It’s definitely not “Simple” since you have all the important tabs located in one place and the charts are updated by the millisecond. This gives the trader that “control” feel and gives you the confidence to trade and profit from the moves that you are about to take.

The reason behind this is the BitMEX software that they are using. The BitMEX market maker is an adaptation of the popular software Liquidbot which is written in Python. The bot allows the traders to get a hold of two-sided markets which also supports permanent API keys which is great for seasoned trading veterans that want to run their own trading strategies.

Unlike other exchanges in where they would have their own currency running the joint, here at BitMEX.com they generally use BTC which is great since it doesn’t create a synthetic market within the trading platform itself. Traders will really get the feel of trading real-time BTC and another crypto from the market. Read more here.

Customer Support

In all our reviews, we have always stressed how important it is to have an awesome customer support. This is because having a solid channel to get a hold onto when things go crazy is the key to any successful online business today. It would be impossible to see online businesses going more than a year without having a good customer support. The website has been operating since 2014 and that has been a good four years, without proper support, will they be able to reach two years?

Customer support starts from the really basic FAQ page. The FAQ page here at BitMEX.com provides all the necessary answers to questions that are mostly being asked by new traders like what are the different contracts being offered online, what are the available leverage and what does leverage do, how to get liquidation and all of the important things that new traders ask.

For other channels, they also have Weibo, WeChat, Telegram, Twitter, and Reddit pages. The website does not offer any phone number to call but customers will be able to submit a ticket and get a reply to the registered email used within 24 hours of submitting a ticket. Multiple languages are supported which include Chinese, French, Korean, and Japanese aside from the default English language.

Bitmex Supported Countries

All countries except:

- United States of America

- Québec in Canada

- Hong Kong

- Seychelles

- Bermuda

- Cuba

- Crimea and Sevastopol

- Iran

- Syria

- North Korea

- Sudan

- any state, country or other jurisdiction that is embargoed by the United States of America

Security

Security can be often confused with simple passwords that you provide once you create an account. A simple password connected to your registered email can be easily breached. That is why most of the websites today offer Two-Factor Authentication features that provide additional security to their customers’ accounts.

To access the security tab all you need to do is click your account name found on the upper left hand side of the website and choose “Account & Security” tab which will then redirect you to a page wherein you will be able to change your personal info, contact info and of course, choose which 2FA you want to activate. BitMEX.com provides two options namely Google Authenticator and Yubikey depending on your preference.

The website also offers strict IP pinning, safe session duration (which auto logs out the account for a given time if not active) and of course, PGP Key for added extra security for people that want to have this feature turned on. All of these security features can be found under the Account tab and is very easy to understand and go around with.

User Experience

Now comes the most interesting part of this review, what do people say about BitMEX.com? There are a lot of mixed reviews about the website but good for us, there are only a few negative comments regarding their service. One that has caught our attention was the issue of a user having issues with his/her funds which can be followed through the website that they purposely made due to this issue. Click on this link to be redirected to that website.

Issues like these are the ones that we need to be aware of before committing to any online websites today. This ensures us that it is really important to read about the website beforehand and know more about them first to be properly educated on other people’s user experience.

On the other hand – there are scam accusations about every broker and exchange on the internet. In our experience over the last 2 years, Bitmex.com is a very reliable and trustworthy exchange.

FAQ – Frequently asked questions about BitMEX

- In which countries is BitMEX allowed?

- Can US citizens use BitMEX?

- How do you use BitMEX in the US?

- Does BitMEX need KYC?

- What coins are supported on BitMEX?

- Can you buy bitcoin on BitMEX?

- How do you withdraw money from BitMEX?

- How long is BitMEX withdrawal?

- How do I deposit into BitMEX?

- What happens when you get liquidated on BitMEX?

- What happens when BitMEX futures expire?

- What is the maximum leverage on BitMEX?

- What is the funding rate on BitMEX?

- What is a perpetual swap on BitMEX?

- What are the fees on BitMEX?

- How high are the fees on BitMEX compared to other exchanges?

In which countries is BitMEX allowed?

BitMEX is allowed to be used from around the world, however, there are certain countries that are restricted from its services due to local regulations or international sanctions. Currently, BitMEX provides services to residents in more than 180 countries. The following is a list of BitMEX restricted countries: United States of America, Québec in Canada, Hong Kong, Seychelles, Bermuda, Cuba, Crimea and Sevastopol, Iran, Syria, North Korea, Sudan

Can US citizens use BitMEX?

No, US citizens cannot use BitMEX. Due to the local regulation in the United States, all broker-dealer platforms must be authorized by the CFTC, the Commodities Futures Trading Commission. Since BitMEX does not have this license, they cannot offer services to US residents.

How do you use BitMEX in the US?

If you are a US resident, there is no legal way to use BitMEX. If you are just (temporarily) located in the United States and want to use the trading platform, you can use a VPN service like ExpressVPN or CyberghostVPN that can change your IP address, therefore, change the country BitMEX sees you are connected from. Please note however BitMEX specifically prohibit any kind of method to disguise your true location in their terms and conditions and if they find this out they can suspend your account immediately and your funds can be lost forever.

Does BitMEX need KYC?

No, there is no KYC process on BitMEX, you can trade anonymously on the trading exchange. For registration, they only require an active email address and filling out the country of residence, but there is no need to provide proof of address later on. KYC is the verification process where you provide personal identification documents, like ID card or passport, along with proof of residence, like utility bills) so the exchange can verify your identity and comply with anti-money laundering regulations. Fortunately, BitMEX does not require users to go through KYC to trade on the exchange.+++ 2020 August Update: Bitmex officially requires KYC from all users +++

What coins are supported on BitMEX?

There are eight different cryptocurrencies you can trade on BitMEX. The following coins are supported on BitMEX: Bitcoin, Bitcoin Cash, Cardano, EOS, Ethereum, Litecoin, Tron, Ripple. BitMEX quotes Bitcoin with XBT ticker instead of the usual BTC abbreviation. In terms of trading pairs, most coins are available to trade against Bitcoin (XBT), but you can trade Bitcoin and Ethereum directly against the USD. Here are the trading pairs supported on BitMEX: XBT/USD, ADA/XBT, BCH/XBT, EOS/XBT, ETH/USD, ETH/XBT, LTC/XBT, TRX/XBT, XRP/XBT

Can you buy bitcoin on BitMEX?

No, you cannot buy bitcoin on BitMEX directly. You need to own bitcoin first before trading on the platform. Since BitMEX do not handle any fiat currency, even for the XTB/USD trading pairs the profit and losses are calculated and settled in bitcoin. If you want to buy bitcoin, visit one of the exchanges which support fiat deposit options with credit card or bank wire payments. Once you have the bitcoin, you just need to transfer it to BitMEX to start trading.

How do you withdraw money from BitMEX?

In order to withdraw money from BitMEX, navigate to your Account > Withdraw, here you can enter the destination address and the amount of bitcoin you would like to withdraw. To finalize withdrawal, click on submit. You will receive a confirmation email where you can confirm your withdrawal. Please note that BitMEX only processes withdrawals once per day, at 13:00 UTC time. There is no minimum withdrawal on BitMEX. BitMEX does not charge any fees on withdrawals, you only need to pay the transaction fee, which is set dynamically based on the network load.

How long is BitMEX withdrawal?

BitMEX sends out funds from the platform only once a day at 13:00 UTC time. Once you have met the cutoff time and submitted your withdrawal, BitMEX sends out the withdrawal right away at 13:00 UTC time. Depending on the capacity of the Bitcoin blockchain the transaction can take 5-50 minutes to confirm.

How do I deposit into BitMEX?

In order to deposit funds into BitMEX, navigate to Account > Deposit, here you will be given your unique deposit address where you can send your bitcoins. This is a multi-signature address and you can only send bitcoin to. After one confirmation the money is credited to your account. BitMEX does not charge any deposit fees and there is no minimum deposit on the exchange.

What happens when you get liquidated on BitMEX?

Since BitMEX offers leveraged trading, to keep these positions opens a fraction of these positions must be held as maintenance margin. Liquidation happens when your balance goes below the maintenance margin and you are not filling up the account after notification. BitMEX use a fair marking policy to avoid liquidation caused by market manipulation or insufficient liquidity. If liquidation notification is triggered, BitMEX first cancels open trades to free up funds to fill the maintenance margin. If this is not enough, the position is liquidated by the trading engine at the bankruptcy price.

What happens when BitMEX futures expire?

The expiration dates of the futures contracts are set in the name of the instruments. The alphabetical letter refers to the month, the number refers to the year. XBT/USD futures contract are settling on the .BXBT30M index, that is a 30 minute time-weighted average price of the BitMEX index ending at 12:00 UTC time. BitMEX index .BXBT tracks the bitcoin price in every minute, and it is a composite index sourcing the prices from various exchanges with different weights. At a BitMEX future expiration, the future’s strike price is compared to the .BXBT30M index and the difference is debited or credited to your account. Perpetual contracts do not have an expiration.

What is the maximum leverage on BitMEX?

The maximum leverage on BitMEX is 100x. You can trade up on leverage on BitMEX on the perpetual contracts, 100x leverage is allowed on the XBTUSD trading pair and 50x-50x on the Ethereum and Ripple perpetual contracts.

What is the funding rate on BitMEX?

The funding rate is a type of fee charged by BitMEX on the open positions. The funding rate is exchanged between the long and short positions holders in each funding interval. The positive funding rate means you have paid funding, a negative amount means you have received funding. Funding happens 3 times a day at 04:00 UTC, 12:00 UTC and 20:00 UTC time, you only have to pay or receive funding rate if you hold a position open this time. Funding is calculated by position value times the funding rate. Only the notional value of your contracts are charged, not the total leveraged position. The funding rate is a complex rate, including components of the interest rate and the premium/discount. For the exact calculation refer to BitMEX’s guide on perpetuals.

What is a perpetual swap on BitMEX?

Perpetual swaps are derivative products on BitMEX that follow the spot market but offers margin trading option. There is no expire or settlement for these instruments, but they work similarly to futures. Since there is no expiration for perpetual contracts, funding is the primary method that helps to anchor to the spot price.

What are the fees on BitMEX?

BitMEX employs a maker-taker fee model for perpetual contracts and traditional futures. Those who provide liquidity to the market are offered a negative -0.025%-0.05% maker fee, which means they get a rebate if they trade. Takers pay a fee of 0.075%-0.25%. The settlement fee is only charged for Bitcoin Futures, in the amount of 0.05%. You also have to pay a funding fee for the perpetual contracts that you have open at the funding interval. The long and short funding rates are updated every 8 hours, and varies between assets. There is no deposit or withdrawal fee on BitMEX.

How high are the fees on BitMEX compared to other exchanges?

The trading fees on BitMEX are relatively low on the market. Bitfinex and OKCoin charge 0.1%-0.2% based on the maker-take fee model for Bitcoin trades.

Pros and Cons

- Futures & Derivatives trading

- Leverage of up to 1:100

- Test trading platform

Cons

- Requires KYC

- Advanced Interface not for beginners

- Does not accept Fiat deposits/withdrawals

BitMEX Review Conclusion

***Update: Bitmex has legal problems with the CFTC, their founders are on the run. We do not recommend trading with Bitmex, you dont know when they will be shut down and your funds may be at risk. ***

Great alternatives for Bitmex are:

- FTX.com for Crypto and Stock Trading with Leverage

- PrimeXBT.com for Trading without KYC

- Deribit for reliable Bitcoin and Ethereum Trading on Leverage

- Bitfinex for high volume Trading on Leverage

Go to BitMEX.com

Bitmex is the biggest SCAM ever. Everything will be ok and you will be trading fine until market turns volatile and this is when you will find yourself trapped with the positions you hold. When you try to place a BUY or SELL order during high volatility, you will get an error message saying something like ” Your order cannot be placed, the system is currently overloaded” . Now even a small child knows that in todays high tech world, its really easy to trade millions of orders even during the highest of volatility, but BITMEX has created this “SYSTEM OVERLOADED” error, so that the poor customers get liquidated and they can rake up even more money. THERE ARE VAST MAJORITY OF PEOPLE WHO HAVE INCURED HUGE LOSSES BECAUSE OF THIS BITMEX TRAP…. AND I THINK THOSE CUSTOMERS SHOULD COME TOGATHER AND SUE BITMEX. After all if you are trading with a company and the company just at once refuses to trade your orders leaving customers trapped with their open postions, then the customers have every right to sue that company.

BITMEX is a dodgy website. It will let you open positions, but when market moves quickly, you will not be able to sell or buy because their system will freeze totally and your position sare liquidated automatically. So for example if you are long, and the market quickly falls, you will watch the market falling, but will be unable to sell your position and you get a message that the market is overloaded. It always happen whenever their is quick market activity.

Hello! Now released a new token!

More information here!

https://bit.ly/2vbB6na

Bitmex doing excellent job in BTC price manipulation for their rekt and termination of open position to close in loss. Moving price down is so fast you can’t believe.

It looks scammer are planning for taking your hard earn money.

Bitmex.com is an absolute fraud. I plead with the admin of this site to take another look and update his review.

First of all it is obvious that most of the volume is fake, generated by bitmex itself. There are only about 8K-10K people online and they claim they generate 5 billion dollars in volume every day, which is a complete lie to keep suckers coming in.

Second, you will get liquidated, and they will take your money. What bitmex does is they open the opposite position as you. So if you go long, they will open a short. And since they see every customer’s liquidation price and stop price, AND they can move their mark price as they please, AND they are unregulated, they very often do so to hit your liquidation price and bankrupt your account.

Third, when you get liquidated, YOU LOSE MUCH MORE THAN THEY TELL YOU. They say that’s because of “risk” to their platform, which is nonsense. If you leverage 10x, you will lose when price falls just 5%, not 10%!

The only thing Bitmex is good at is FOOLING people. Their CEO went on CNBC to talk to completely clueless anchors, and now people think they are legitimate. PLEASE DO YOUR RESEARCH – THIS IS A FRAUDULENT COMPANY.

THEY REFUSE TO ACCEPT US PEOPLE so that they do not have to deal with US LAW. If they had accepted US people, THEY WOULD BE SHUT DOWN AND INCARCERATED immediately given the fraudulent operation they are running.

People are just getting the hang of this and the true nature of the scam that Bitmex is running. PLEASE SPEAK UP if you have been a victim of this scam.

I can confirm that this is definitely a liar company. I set a stop loss but did not execute it and forced the liquidation. I don’t understand why? I hate such scam companies, they are not regulated, so it is not safe, they can use rules to make you bankrupt, away from this company.

Careful on liquidation limits – they liquidate against the index price, NOT the instrument price (or whichever is ‘safer’ for their system to not take a loss). This screwed me really badly. If the index is far off the instrument, then you will get liquidated very easily with high margin.

It’s a cool trading engine, but they don’t really have derivatives. Only futures.

BTC trades against fiat, with several options.

Only BTC is taken for deposit.

Everything else trades against bitcoin.

It’s a reversed system – you get gains / losses in BTC when trading against USD. That can be very confusing at first.

The platform is very unreliable – Any more or less sizable increase in activity and you either cannot submit orders due to “The system is currently overloaded” or cannot even login.

All you left to do is to watch hopelessly the price creeping against you.

IF A PLATFORM IS UNRELIABLE THAT CANCELS ALL ITS GREAT FEATURES!

THE SYSTEM IS OVERLOADED! Oh there’s movement in the market? well too bad because that’s exactly when bitmex doesn’t work for shit! Great platform overall except for at EVERY SINGLE MOMENT THAT MATTERS!!

Hello

I will not add to the list of complaints on how they use their customized liquidation price to blow off your account regularly… Yes, this is a scam…!!

Now they found a new way to steal your money : Unable to get access to your account or to the platform in high volume or quick price moves.. and if you are luckily ON the platform, your order cannot be executed.. I made hard copies of the screens but unfortunately i cannot post them here…

So, if you are unlogged, you will getthe following message when trying to connect:

“API Timeout – Please re-enter your information and try again”….

or

“Form security failed. Your session may have timed out.Pleasere-enter your information and try again”

or

“We are experiencing a server error. We have been notified. BitMex will be back up very shortly. please try again soon.”

I tried successively during 15 minutes… and then my account blew off in between.. obviously… and despite I had a very low leverage

Better…. :

If you are connected.. suddently the market moves agaisnt you quickly… then you want to close your position… here is what will happen :

“Order submission error – Order could not be submitted. The system is currently overloaded. Please try again later”

If you try again ..and again.. and again… :same message… I let you image the consequences on yr position….

SO,these guys are thieves… they are based in Seychelles to avoid any court trial and being sued/

AVOID THIS COMPANY and SREAD THE MESSAGE

I was trading XBTUSD… I had liquidation price set o 11321.5. They closed my position even if price didn’t drop below 11350… and I lost all my asset. This is some kind of joke – I lost like 2000 USD and I doubt that they will respond on my complaint.

Looks like this is well organized fraud. I have no idea where I can report this. I have screenshots of order history, current account status, everything – I was looking very closely what’s going on as I knew this was risky trade… but didn’t risk – they just stole my money.

Ive used bitmex for around 6 months now and whilst the above review is accurate. There is another cost that is becoming prohibitive. The minimum possible transaction fee to withdraw is set at .0046 (currently $85USD) at present. They do not allow you to lower the network transaction fee as many other exchanges do. This fee will likely continue to rise. Paying $85 Just to move my coins around has become too expensive so ill look to move on from bitmex.

am i having bad luck or all the cryptoexchange is all scamers? i first started from bitfinex what a big scam, then i move to bitmex and is another dam scam too. bitmex is all bots, when the bots bet against me i can see the price gain or drop from other site live but on bitmex they never move on my favor when i bet big, they fix the price and make me liquidated and when i go short they pump up the price event when the price droping.

most of all the crypto exchange are scamers so becarefull when picking one. i learn it the hard way.

with all this money going into all the exchange and with no regulation is hard for someone not to break the law and scam you out of your money, there is no law saying they cant taking all your money and runing away.

Bitmex is an absolute scam.

If you want to lose money trading bitcoin, Bitmex is the quickest way to do it. Regardless of where you stop is or even what the liquidation price is , your order inevitably gets put in a liquidation pool & gets stopped out at a price far from the live price.

Total Scam / Bucketshop. Stay away.

Today I decided to join Bitmex because of its ability to short or go long on currencies. I was very excited about trying out this new way of trading on the exchange.

When I signed up and click my confirmation link in my email, I was greeted and reject by this page all in one fell swoop!

I thought maybe it was maybe a glitch in the system, so I decided to try to deposit some money into bitmex to see if it would work. Right when I clicked deposit I was immediately rejected with this web page.

To me this is very frustrating! I know that bitmex works in England, so why are they banning the united states? I was thinking about using a VPN to hide my location in the united states but first I wanted to figure out why they were banned in the U.S.

So first i did a search for “bitmex blocked in the U.S”. When I went to investigate my results for the reason why, I found some very bad reviews that were very well explained. I clicked the link to the website http://bittrust.org/bitmex and here is the first review I found:

Complete crap service. There is no way in hell the five star reviews below were written by anyone other than the owners.

Bitmex is a complete scam. Please read this carefully if you’re thinking of depositing money there, and especially if you’re new to the bitcoin industry or to trading.

First off the fees drain your money: 0.075% at 100x is 7.5% on every open and close of every trade (they don’t tell you that, they just show you 0.075% so you think it’s small, but they charge you 7.5 fucking percent on your margin when you trade with leverage).

The “team” behind bitmex is just two guys in their twenties looking to get rich / scam uninformed/noob traders out of their money. It’s an amateur operation. It’s also completely UNREGULATED. There’s no financial watchdog monitoring what these people are doing behind the scenes.

If bitmex were to be regulated, or should financial regulators catch on to them, the owners would be behind bars.

Especially because the owners have many times used pseudonyms in forums online to advocate for “US customers to use a VPN” (even in the bloody reviews on this page!) – not only are they encouraging illegal behavior but that’s the only way their operation can survive because most of their volume is US-based.

They incorporated their operation in Seychelles to make it jurisdictionally hard to sue or pursue them. There are many stories online of people trying to do just that after losing their account balance on Bitmex.

The owners are also moderators of a semi-popular online bitcoin forum so they censor all kinds of criticism toward bitmex and use the forum to pump up and drive traffic to their operation.

There is not a single story, comment, or review online of anyone making money on Bitmex.

You get lost so easily in the trading interface. It’s as if they make it complicated on purpose. Most of the volume on there is generated by the owners with their market making algorithms to make it seem like the site is popular.

You’ll get liquidated pretty quickly, especially if you have a small account. They’ll make the price feed wick instantly to hit your stops and liquidate you (it’s simple to manipulate at 100x). That kind of liquidation is a straightforward transfer of money from your deposit to their coffers. Stay away, stay away, stay away.

Use Poloniex, Whaleclub.co, Okcoin, Bitstamp, or another reputable service. The owners of this operation only care about their own pockets.

Edit: On the reddit page here some of the confusion of the systems UI and the 50x margin trading “gambling” is talked about by some of the users there too.

Well bitmex isn’t looking good after all. That review is well echoed by others on bittrust too saying it is not a good exchange service. Anyone have any experience using it?

So looks like I will just be sticking to bitshares and poloniex! Fine by me. Happy trading everyone!