CoinFLEX – Scam or Not?

Coinflex is the first cryptocurrency exchange on the world which offers physically delivered bitcoin futures. There is no cash exchange that happens at settlement, everything is delivered in crypto. Beyond the low fees, Coinflex also offers leveraged bitcoin and stablecoin trading up to 20x which makes them one of the most unique service provider in the crypto space. Let’s see what this exchange can offer for traders who are looking for physically delivered crypto derivatives.

Review Contents

- About the Company

- Services Offered on Coinflex

- Deposits & Withdrawals

- Available Order Types

- Trading Fees

- Exchange Security

- Supported Countries

- Conclusion

About Coinflex

Coinflex is operating by Liquidity Technologies Ltd., a company incorporated under the International Business Companies Act of the Republic of Seychelles. The platform has been opened to the public at the beginning of 2019. Although the administrative headquarter is in Mahe, Seychelles, the company is operated from Hong Kong as their initial target market was the Asian trading market, both for retail customers and for commercial clients.

Coinflex employs professionals with versatile backgrounds, from trading technology specialists to crypto veterans, from market makers to venture capitalists. More than 20 different specialists work at Coinflex at the moment. The company is backed by VCs such as Dragonfly, Trading Technologies, Roger Ver and Mike Komaransky according to the CEO’s Linkedin Profile.

Mark Lamb is the founder and CEO fo Coinflex since 2018 December. Prior to that, he has been leading Coinfloor exchange, the leading crypto exchange in the United Kingdom. He has a background in IT, marketing and trading, he has been dealing with cryptocurrencies since 2011. His visionary work has been rewarded by Hult International Business School twice when he received an Entrepreneurial award in 2012 and 2013.

James Cunningham, the CTO of Coinflex has been graduated at the University of Leeds with a BSc in Mathematics and Computer Science. He has been working with Mark Lamb at Coinfloor previously. He has 10+ years experience in high frequency trading including several positions at high profile investment banks.

Company is actively posting on social media channels like Twitter and Medium. They run their own blog on Medium, sharing various walkthroughs about the exchange to educate their user base.

Services Offered on Coinflex

One the major unique feature on Coinflex is the physically delivered cryptocurrency futures available at Coinflex. At the end of the contract, during the settlement you receive or delivered digital exchanges, no matter what is the price, you hand over or receive cryptos directly.

One the major unique feature on Coinflex is the physically delivered cryptocurrency futures available at Coinflex. At the end of the contract, during the settlement you receive or delivered digital exchanges, no matter what is the price, you hand over or receive cryptos directly.

This removes the possible price manipulation risk which is often experienced on cash settled crypto exchanges. Price manipulation can occur just before the settlement date of futures, where big market players can tweak the crypto prices in a way to be favorable at delivery.

Coinflex has a strict policy on avoiding in-house trading. There is no in-house trading desk at Coinflex to avoid competing with its customers and make sure the market is fully transparent for each market player.

Margin trading is available at Coinflex up to 20x leverage, where you can fund your account directly with cryptocurrencies, such as Bitcoin or Tether.

Their super high-performance API can handle up to 200 API orders/sec per user to streamline your automation with the fully featured REST API and Streaming Websocket API.

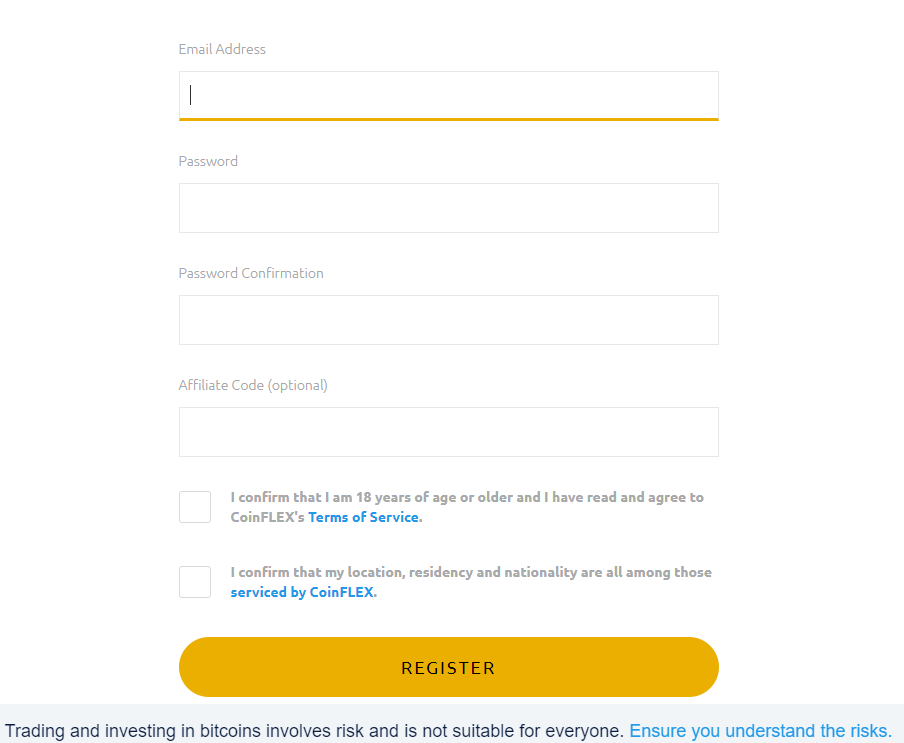

If Coinflex finds out a user has given false representation regarding its residency, Coinflex may close the account and liquidate any open position right away. Make sure you are aware of the terms and conditions before you sign up.

While retail clients can benefit the high leverage, commercial clients can also benefit from the physically delivered futures contracts. Cryptocurrency mining firms can find physically delivered bitcoin futures very favorable, given their output is presented directly in crypto. Commercial hedges are available for miners, OTC derivatives trading desks and for global proprietary trading firms.

Coinflex goes beyond providing a trading service. They also have their own coin, Flex Coin which you can use on the platform.

They also expanded the futures concept by ‘initial futures opening’ (IFO). IFO will provide exposure to token projects that are fundraised via private sales. Coinflex aims to solve these problems of “over-margined on the short side” meaning there is more margin posted for short sellers than the value of the underlying coins.

They also expanded the futures concept by ‘initial futures opening’ (IFO). IFO will provide exposure to token projects that are fundraised via private sales. Coinflex aims to solve these problems of “over-margined on the short side” meaning there is more margin posted for short sellers than the value of the underlying coins.

IFOs allows users to take positions in either way: if you think a project will go to the moon, then you can buy futures, if you think it will fail miserably, then short the futures. The first IFO project is Polkadot’s DOT token.

Coinflex’s designated market maker program pays out up to 10M USD to 10 qualifying market making firms. This initiative has been put in place to increase market adoption for cryptocurrencies. Read more about the program here.

Getting Started on Coinflex (Deposits & Withdrawals)

To register at Coinflex, provide your email and password in the registration form. You must accept the term of service of Coinflex, including that your residency is provided according to your real location. They also ask you to accept cookies before you can sign up.

Before you can start trading, deposit bitcoin to your account. This can be done without KYC verification. In order to deposit USDT or USDC stablecoins, you need to verify your account further by providing a photo ID and a proof of residence.

You can withdraw Bitcoin, Tether or USD Coin from Coinflex directly to your wallet. For security reasons, Coinflex does not allow reusing the same withdrawal address multiple times. CoinFLEX is not a wallet service and does not allow payments or third party withdrawals. They require all clients to withdraw their bitcoins directly to the client’s own wallets

The minimum deposit and withdrawal amount is 0.001 bitcoin, 10 USDT, and 10 USDC.

Manage the deposits and withdrawals from “My Account” dashboard. Conversion is a tool that allows you to move assets from spot balances into futures balances and vice versa. On the expiry of the contract you have traded, you must convert your futures balances (including potential profits) back to spot BTC, USDT or USDC balances.

Trading on Coinflex and Order Types

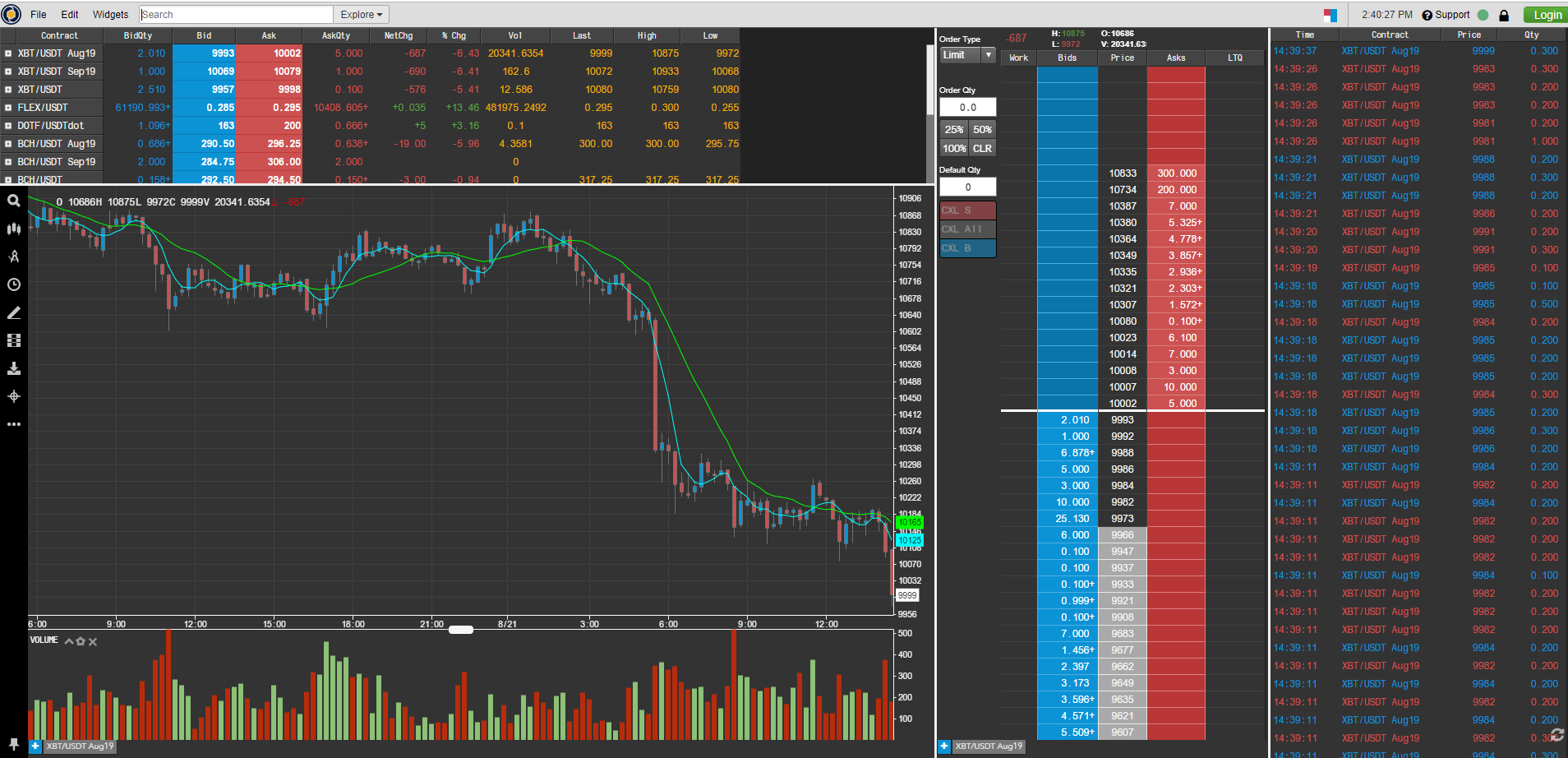

Go to the Exchange tab to start trading on Coinflex. The dashboard is a multiscreen tool where you can follow the market movements from every aspect.

On the chart, you can draw trendlines and expected price movement, indicators and set chart types. There are many different charting tools you can choose from, the technology is built directly by Coinflex and not provided by TradingView.

The orderbook is refreshed constantly in the fraction of a second to show market depths, although graphically is it not that representative compared to other trading platforms.

You can select market, limit and trailing order types on Coinflex.

The bid/ask spreads of the various trading instruments and futures can be followed on the top of the screen with their average daily volumes to give an indication where is the market heading.

Overall although the platform indeed has some great features to offer, the trading dashboard is not that user friendly and might be confusing for new users. However, once you have got used to the design you can get around the screen more easily.

Pricing on Coinflex

Coinflex’s fee schedule is a bit hidden from users, you can find it here.

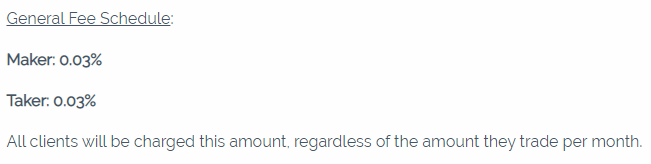

They use a maker-taker fee schedule, where both the makers and the takers charged with 0.03%, this is a fairly low fee on the market. All clients will be charged this amount, regardless of the amount they trade per month.

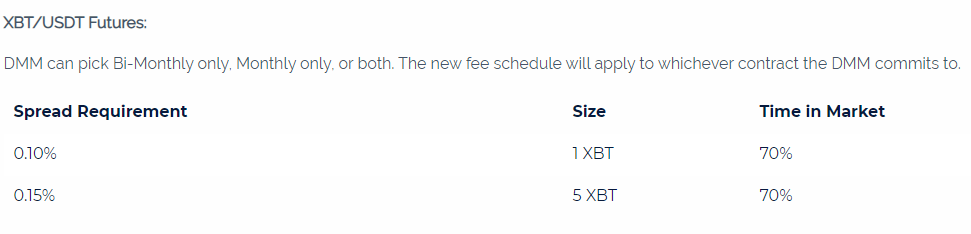

In addition to this, Coinflex offers Designated Market Maker (DMM) program for each futures contract in order to secure committed market makers looking to provide continuous, two-sided liquidity. To receive funds from the program, market makers must meet the minimum thresholds of technological proficiency and market expertise. This means 0.1% spread for 1XBT contract size and to be available on the market 70% of the time. Several market making firms have also equity in Coinflex.

CoinFLEX does not charge fees on deposits.

When withdrawing, CoinFLEX charges a 0.03% processing fee with a minimum of 0.0005 XBT / 5 USDT / 5 USDC.

User Experience and Security on Coinflex

The security practices used on Coinflex are based on the track record of an exchange which did not have any security issues at all during the past 6 years. As the founder of Coinflex along with the Chief Technologies Officer are both coming from Coinfloor, a crypto exchange working since 2013 they have a vast experience in running a trading platform securely.

Coinflex is serious about security. They store the 99% of the Bitcoins in cold storages, the rest of the coins which are needed for the day to day operations are stored in secured hot wallets. There is no single person, vault location or device failure can compromise the integrity of wallets.

Two-factor authentication is compulsory to be able to login your account at Coinflex to avoid unauthorized access to your account. You can use Authy app to access your account or YubiKey a USD stick OTP generator. SMS authentication is not considered as a safe 2FA method by Coinflex, so it is not supported.

There are a lot of features available for advanced traders on the platform, including the IEO Flex Coin and the IFO feature which lets you trade on very illiquid assets. All of the products and services are detailed out in the FAQ section. In case you have any questions or issues, you can turn to the Support by email or through their Telegram chat.

There is no scam report available about Coinflex, users rather praise the exchange for the unique services they offer, the physically delivered bitcoin futures and the initial future offerings.

Supported Countries

All countries except: Afghanistan, Central African Republic, Chad, Congo Dem. Rep., Congo Rep., Cuba, Eritrea, Ethiopia, Iran, Korea, North, Libya, Myanmar, Nigeria, Québec (Province), Sierra Leone, Somalia, South Sudan, Sudan, Syria, United States, United States Minor Outlying Islands, Yemen

If you are a resident of any of these countries you are prohibited from holding positions or entering contracts at Coinflex, no matter if you managed to open an account.

Conclusion

Coinflex offers unique features on the market in the form of physically delivered bitcoin futures and futures on illiquid assets (IFO). The platform has a great focus on security including the compulsory 2FA and the cold storage of the Bitcoin vaults. The staff behind Coinflex has been working on other crypto exchanges in the past, so they have an indepth market experience specifically applicable to crypto derivatives trading. Although the trading platform is designed by them and it has many features it might not be suitable for newbie traders due to the complexity of products.

Pros

- Founders have clear track record in crypto trading

- New features: Initial Futures Offerings

- Physically Delivered Bitcoin futures

Cons

- Might not be suitable for newbies

- New company

- No fiat support